Starknet DeFi Pooling – How Can I Earn Passive Income with my ETH?

A comprehensive guide to maximizing your ETH returns, even as a small investor.

In the ever-evolving world of Decentralized Finance (DeFi), you’ve asked us: How can I earn passive income with my Starknet ETH sitting in my Braavos wallet?

Here’s an honest, informative Starknet Defi guide to help you understand the opportunities and potential risks in staking and liquidity provision thanks to Starknet.

What is Staking and Why is it Important?

You might have wondered what staking means in the cryptocurrency sphere. Staking is the process of locking up your tokens to support network operations such as transaction validation and block production. In Ethereum’s case, staking is crucial to secure the network and enable its Proof-of-Stake (PoS) consensus mechanism.

Your staked ETH earns rewards, creating a passive income stream. We consider it as the lowest-risk crypto investment on Ethereum because if staking fails, it implies a significant issue with the entire Ethereum ecosystem. If we were to draw parallels with traditional finance, staking ETH is akin to investing in the 30-year U.S. Treasury Bill.

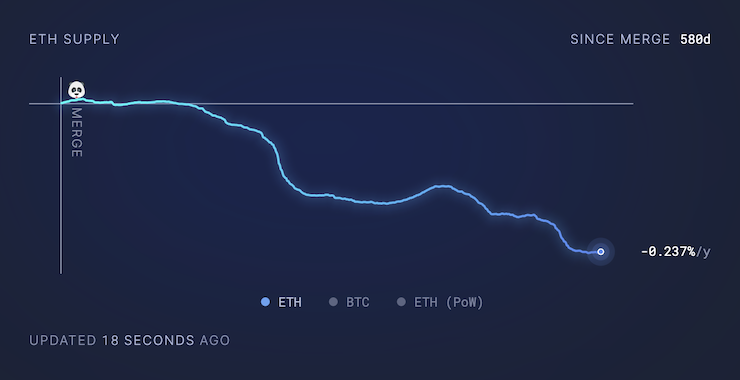

Moreover, since September 15, 2022, Ethereum has adopted a deflationary policy, reducing its supply by 0.24% since the Ethereum Merge.

What’s the Problem with Staking on Ethereum Today?

The major issues with staking on Ethereum today, once withdrawals were enabled with the latest Ethereum protocol Shappella upgrade, are two:

- You need to have at least 32 ETH to stake.

- High gas fees for staking deposits and withdrawals on the Ethereum network make smaller investments uneconomical.

To solve the first issue, protocols like Lido and RocketPool emerged. These protocols allow users to deposit any amount, grouping these deposits together until reaching 32 ETH. These protocols charge a fee from the staking rewards (in Lido’s case, it’s 10%).

The second issue is the high gas cost to perform the staking transaction. For example, during May 2023’s bear market, the average cost for a stake deposit, getting a wrapped staked token (wstETH), and later withdrawal was above $30. This makes smaller investments less viable.

For example, a user who wants to invest $1000 worth of ETH for a period of 1 year, will lose 3% only for gas costs.

How can I avoid paying these high gas costs?

Enter Starknet, a Zero-Knowledge / Validity rollup (layer-2) solution on Ethereum. Starknet uses advanced STARK technology to compress many transactions into a single proof, which is easy to verify on Ethereum, thus helping Ethereum scale and significantly reducing gas price and transaction fees. However, staking can only be done on Ethereum’s base chain (layer-1).

The solution? DeFi Pooling!

What is DeFi Pooling?

Pooling aggregates funds of many users in a smart contract on Starknet. Once the pool reaches a critical mass, the funds are seamlessly bridged to Ethereum layer-1. From there, they can be invested in any protocol (for example the reputable Lido service). The resulting tokens (e.g., wstETH) are bridged back to Starknet’s layer-2. This unique process shares the otherwise high gas cost associated with Ethereum layer-1 transactions among multiple users, significantly cutting individual expenses.

The result is easy and inclusive access to high-yield ETH staking, even for small-scale investors.

Understanding Risk Reward

Risk is usually directly correlated with reward. Therefore if ETH Staking is considered the lowest-risk investment, it likely yields the lowest reward too. The reason for this is that any alternative DeFi investment on the Ethereum network presents higher risk and, thus, investors demand higher yield.

How Can I Earn High Yields?

Another method you might consider for earning yields is by providing liquidity to an Automated Market Maker (AMM). This involves depositing an equal value of two tokens in a decentralized exchange’s liquidity pool. The advantage? You earn trading fees from your pool and contribute to a more efficient DeFi market.

Nevertheless, it’s essential to be transparent about potential risks. One key risk when providing liquidity is impermanent loss (IL). This can occur when the price of your staked tokens changes, potentially causing losses upon withdrawal.

This risk can be mitigated when using relatively pegged tokens, like stablecoins.

How Do I Create the Optimal Starknet DeFi Strategy?

To make the most of staking and liquidity provision in the Starknet DeFi landscape, we recommend considering the following:

- Start by staking your ETH. You can pool and bridge them to Ethereum Layer 1 (L1) to earn staking yield.

- Then, take your staking token (E.g.: wstETH, a tokenized form of staked ETH) and pair it with ETH to provide liquidity to the ETH-wstETH pool on an AMM.

This approach enables you to potentially achieve double-digit yields due to the high ratio of pool volume to TVL (Total Value Locked) in the relatively nascent Starknet DeFi ecosystem. The potential for higher yields is due to the way liquidity providers earn fees. Essentially, fees are accumulated from trading volumes – the higher the volume, the greater the fee. These fees are then distributed among all liquidity providers proportionate to their share in the pool’s Total Value Locked (TVL). So, a high ratio of pool volume to TVL generally indicates more fees being distributed, which in turn can lead to higher yields.

And the best thing is, the Braavos Wallet Stake+ embedded protocol can perform this complex DeFi strategy for you in just one-click

Conclusion

In response to your queries about Starknet and DeFi, we believe that combining staking and liquidity provision can lead to significant returns. However, it’s crucial to understand the associated risks and ensure you are comfortable with them before proceeding. DeFi investments always carry a degree of risk, and you should always do your own research before investing. As always, we’re here to educate you on these concepts and help you make the right decision for you.

Remember, your success is our success. We encourage you to engage with us, ask us more questions, and help us to continue providing you with the most accurate, transparent, and valuable information about the potential of Starknet DeFi.