Nimbora: Earn Yield With Restaking And Liquid Staking

Nimbora is a Starknet-based omnichain 1-click yield strategy platform that enables users to engage with Layer 1 protocols at a fraction of the cost. Nimbora is here to bring the future of gasless, scalable, and inclusive cross-chain DeFi to Starknet!

Braavos users can put to use their $DAI and $ETH assets in earn strategies that are currently live on Nimbora. Every two weeks Nimbora will release a new strategy with the best APR on Starknet and other additional perks for their users. You can follow up with the latest news on Nimbora X (Twitter) and their Discord channel.

Earn Yield With Liquid Staking And Restaking On Nimbora:

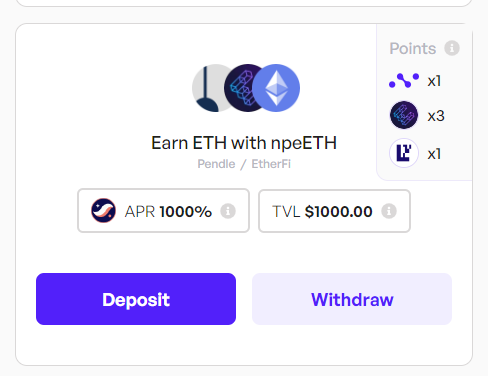

As an example, you can earn yield on your ETH and farm points with 3 protocols: 1x Nimbora, 3x EtherFi, 1x EigenLayer with npeETH strategy.

And yes, these are the correct numbers 😊 This is the current APR on Nimbora and you should use the opportunity to earn! Entries are capped and they will increase them occasionally.

- Pendle is a protocol initially deployed on Ethereum that provides a market for the yields of supported yield-bearing tokens*.

- Etherfi is a decentralized liquid staking protocol built on the Ethereum blockchain. It allows users to stake their Ethereum (ETH) while retaining control over their private keys.*

- npeETH is the Nimbora yield token representing the L1 strategy yield-bearing token, increasing in value at each epoch. Once minted, it can be used in DeFi through the Starknet ecosystem.

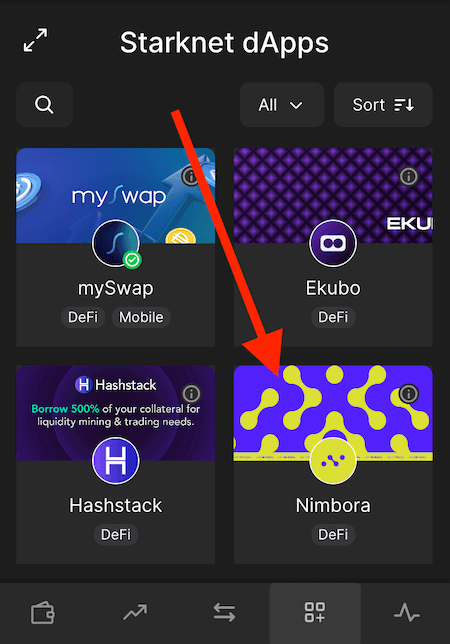

Nimbora is currently INVITE-ONLY, and we’re thrilled to offer our users this exclusive opportunity. Join Nimbora through Braavos and get a 20% boost on your points! Nimbora is featured in the dApp Gallery on Braavos too! 🖼

How Braavos Users Can Earn High Yield on Starknet: Short Guide👇

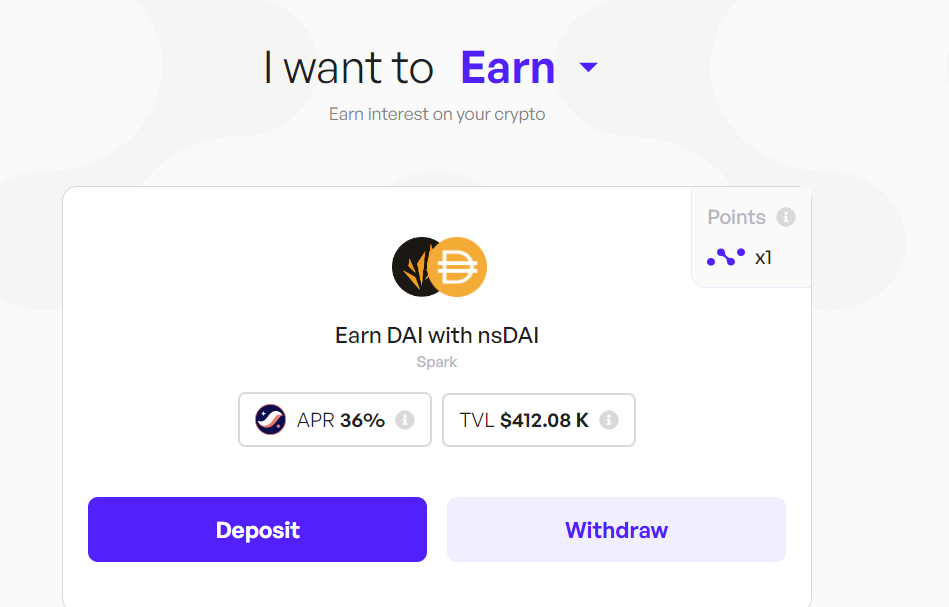

Here is another strategy enabling you to earn yield on your DAI, farm Nimbora points, without the risk of impermanent loss.

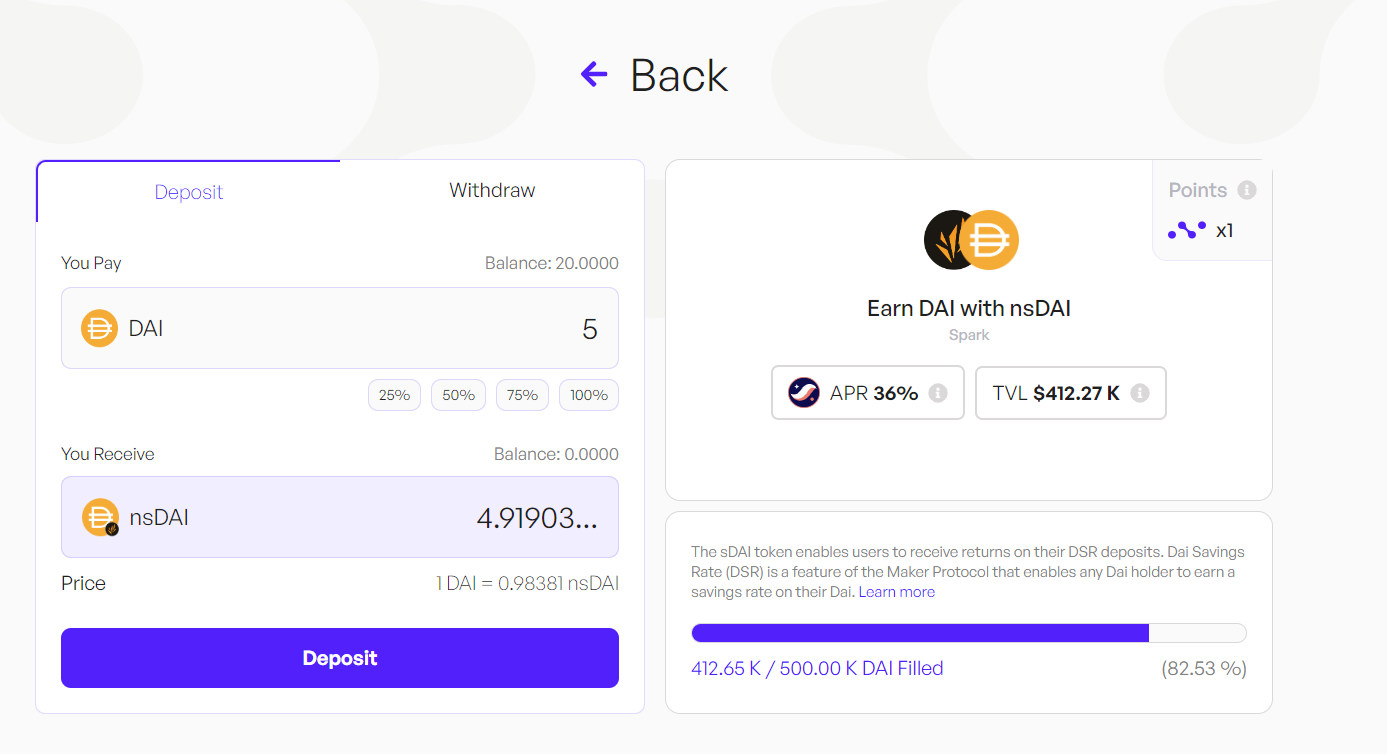

Here’s how Braavos users can earn the best yield on Starknet👇

Click on https://app.nimbora.io/referral/?ref=zJ5q5ztQ and connect your Braavos wallet.

Enter the amount of asset you want to deposit. Alternatively, click on the small buttons below the box to set a desired percentage of your balance for deposit. For this example, we will use $DAI.

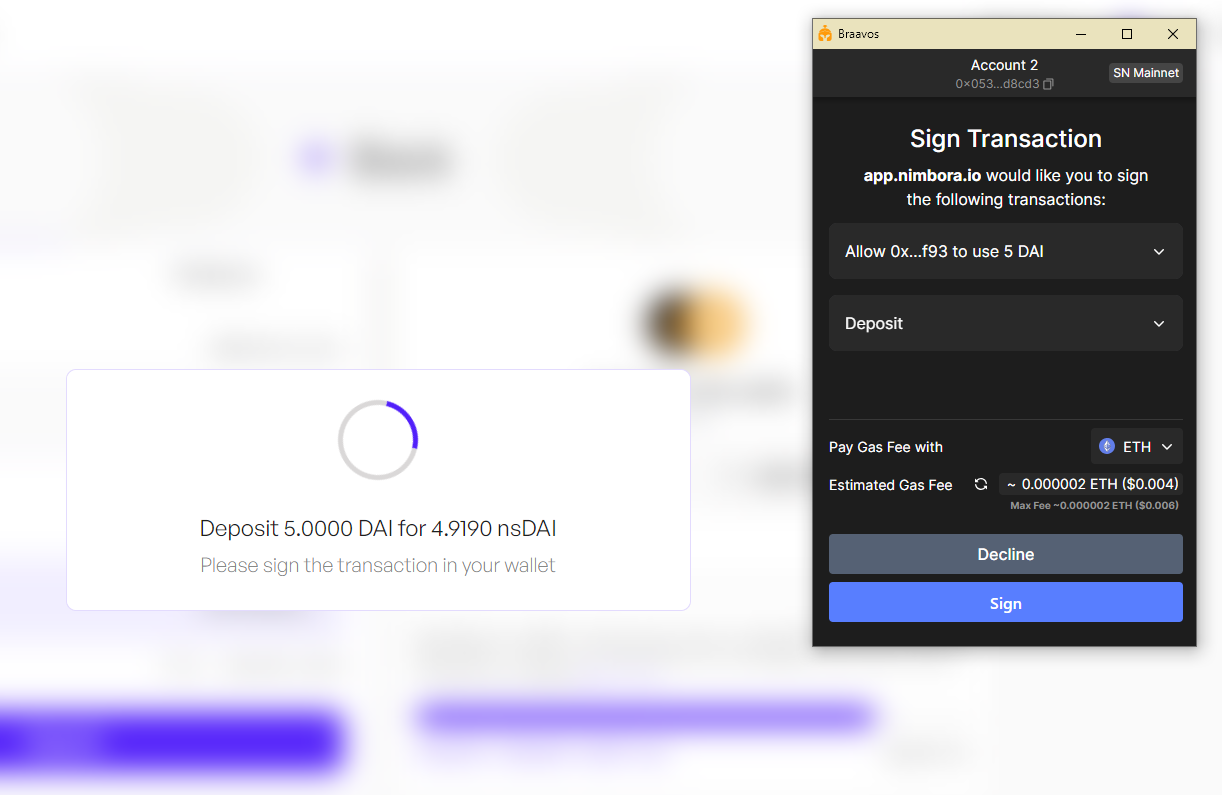

When you’ve selected the token amount to deposit, click “Deposit” and follow the prompts on your wallet to complete the transaction.

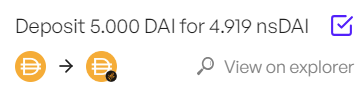

Once the transaction has been accepted on the network, a popup will appear at the bottom left of the screen.

And that’s it! You should be able to see your balance of Nimbora yield tokens in the portfolio section or directly in your Braavos wallet.

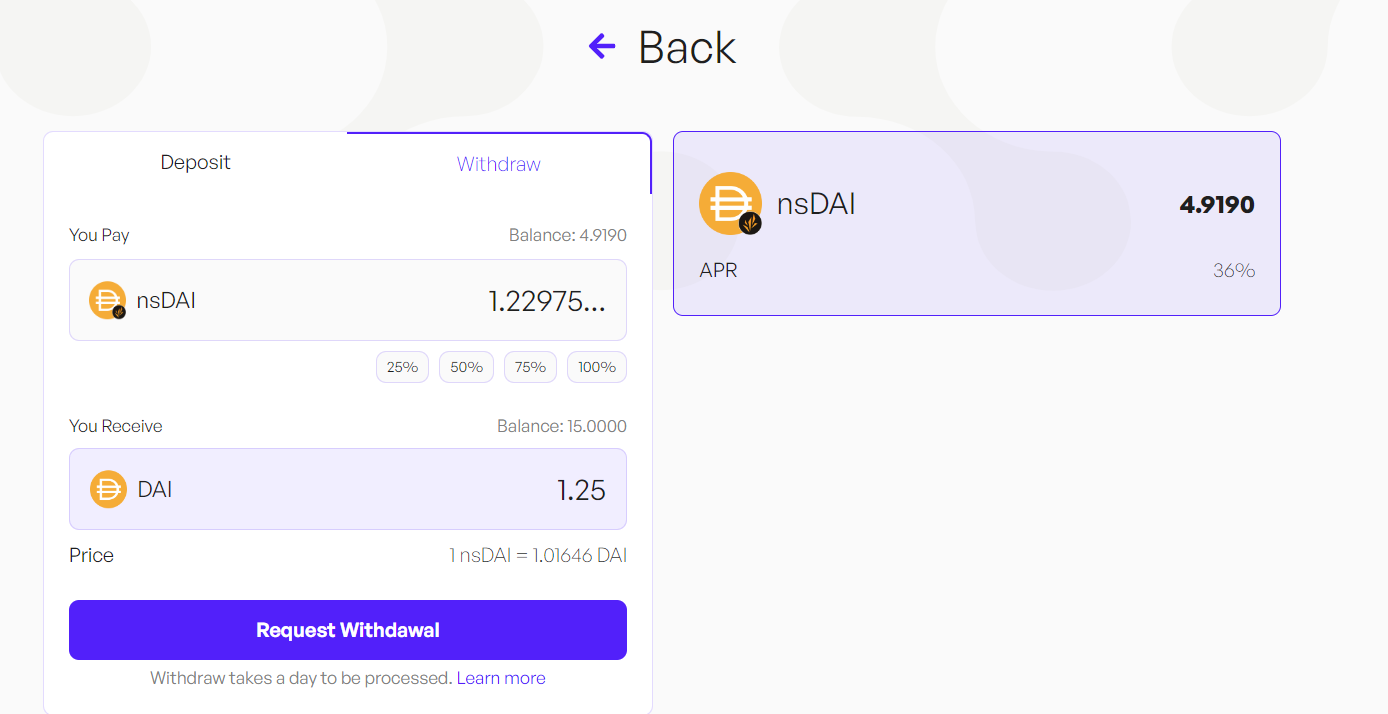

How To Request A Withdrawal

Withdrawals are not as quick as deposits. They take an average of one day to process. A fast withdrawal option will be available on Nimbora in the next development stage.

For a mini guide on how to request a withdrawal, visit this page.

Are you investing in ETH strategies?

When you invest ETH with Nimbora, Nimbora stakes and restakes it for you, then swaps it into liquid restaking tokens (pufETH or weETH) based on your chosen strategy. Liquid restaking on Ethereum lets your staked ETH do more, like help validate external systems (rollups, oracles, etc.), which makes the whole ecosystem stronger.

Liquid Restaking Tokens (LRTs) have your back with protection against slashing events and offer better yields than regular staking. Plus, they make it easier to get involved, manage risks, and save on gas by batch-collecting rewards.

Are you investing in USDC strategies?

If you’re putting your USDC to work, Nimbora converts it into FUSDC or stUSD.

FUSDC is an interest-bearing token you get when you drop USDC into Flux Finance’s lending pools. It’s like holding your original USDC but with interest added over time, so your balance grows as the lending pool’s interest rate does.

stUSD gives you yields through real-world assets (RWAs) and DeFi assets in the reserves of Angle Protocol.

Are you investing in DAI strategies?

With DAI, Nimbora puts it into an sDai vault, which is a cool financial tool that works to generate potential profits. This strategy mixes DAI’s stability as a stablecoin with the profit potential of DeFi strategies.

Where’s the yield coming from?

ETH:

- Ethereum staking rewards (Execution & Consensus Layer)

- Loyalty points from the Puffer Protocol for staying consistent

- Extra rewards from EigenLayer restaking activities

- STRK rewards from Starknet DeFi Spring

USDC:

- Interest from Flux Finance lending pools

- RWAs and DeFi assets in Angle Protocol’s reserves

DAI:

- Fees from the Maker Protocol when people borrow DAI

- Treasury earnings from Maker Protocol

For more information about Nimbora you can: