Staking Boost, ETH Staking with Extra Yield

Braavos Exclusive

Censorship Resistant

Account Abstraction

Crypto Innovation

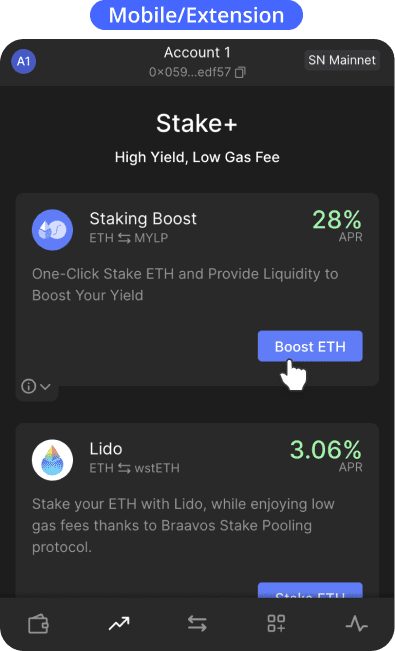

It’s like staking on Ethereum but with extra yield, without the high fees and directly from your Starknet wallet.

Generate the highest yield from your ETH on Starknet

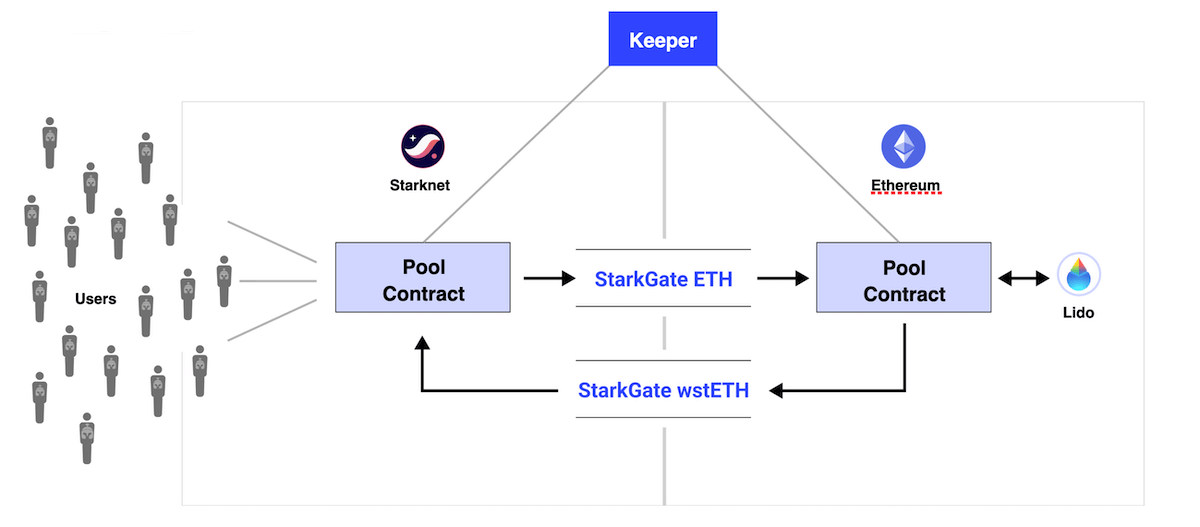

By utilizing DeFi Pooling technology, Stake+ splits the high gas costs of Ethereum Layer 1 (L1) across dozens of participants, thereby substantially lowering the gas fees for each individual user. With reduced gas fees, small-scale investors can maintain profitability, as these costs no longer consume their entire yield.

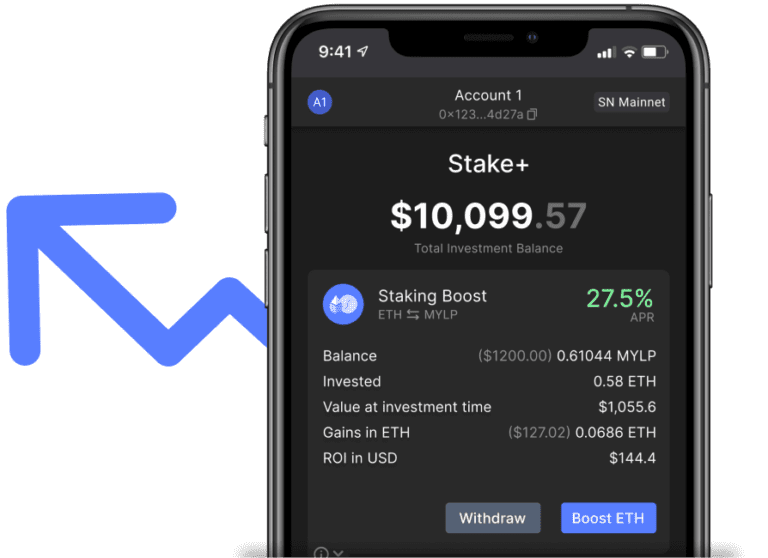

Staking Boost enables you to earn an extra yield on your staked ETH by becoming a liquidity provider in the ETH-wstETH pool on mySwap AMM. All this in one click.

Let’s say you want to invest 2 ETH:

- 1 ETH is staked on Lido through Ethereum L1. Lido will send you back 1 wstETH.

- This 1 wstETH and your remaining 1 ETH are now sent into an ETH-wstETH liquidity pool on mySwap AMM.

Where does the yield come from?

Your total yield is the sum of:

- the yield generated from your 1 ETH staked on Lido

- the yield from the liquidity pool, generated by the swaps made between ETH-wstETH on mySwap AMM

The formula is:

(1 ETH * Lido_pool_apr) + (1 ETH * wstETH staking_apr * mySwap_pool_apr)

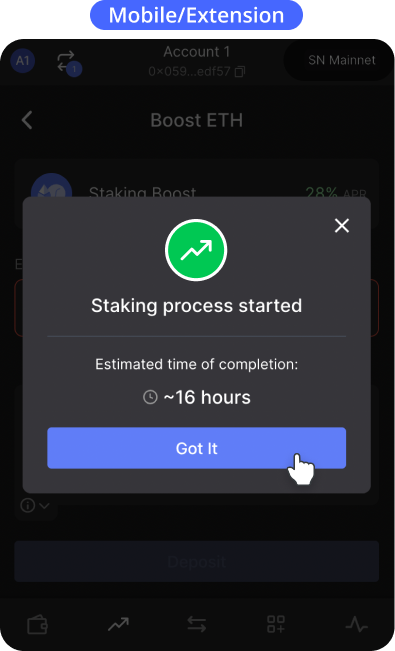

How long does it take?

Staking Boost takes up to 16 hours. This includes bridging ½ of your ETH to Ethereum, staking it through Lido, returning it as wstETH to Starknet, distributing the liquid token into your wallet and locking your wstETH and your ETH in a liquidity pool on mySwap AMM to earn extra yield.

Similarly, withdrawing ETH also requires up to 16 hours, encompassing the withdrawal of your funds from mySwap AMM, bridging of wstETH to Ethereum, unstaking through Lido, and bridging the ETH back to Starknet.

The number of hours required for a roundtrip is expected to drop dramatically as Starknet gets more mature.

Staking Boost or withdrawing happens in one click.

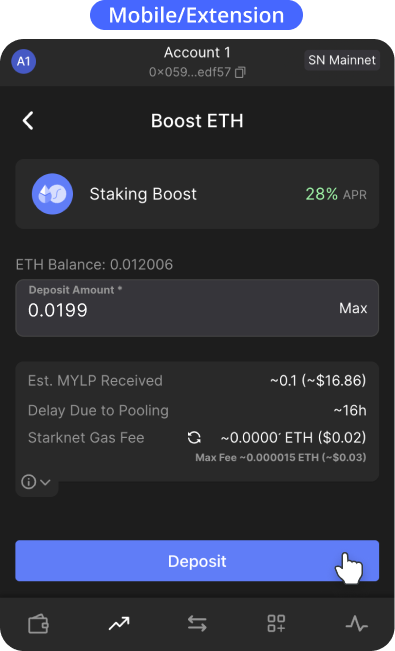

How much does it cost?

The cost to stake or unstake is approximately $0.3. This covers the transaction on Starknet and a portion of the shared fees on Ethereum.

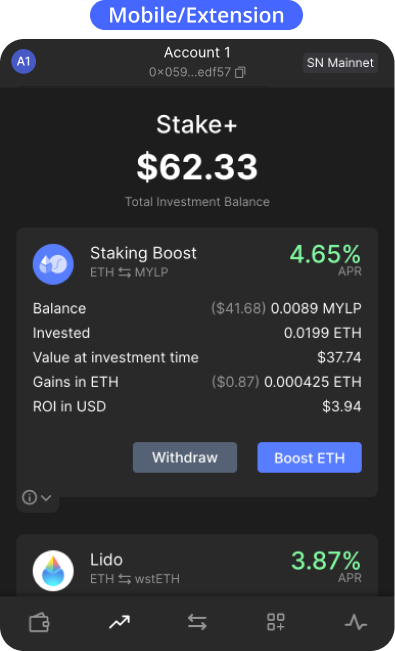

How can I see the details of my investment?

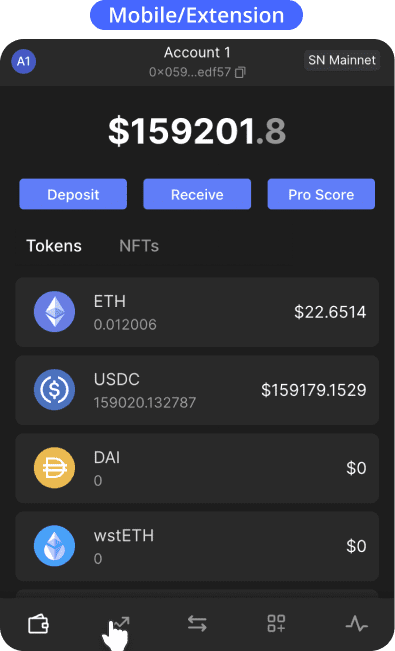

The Stake+ tab in your Braavos wallet displays details about your staked ETH:

- “Balance” – Your current balance.

- “Invested” – This represents the total cost of your investments at the time of transaction, including assets sent, received or swapped.

- “Value at investment time” – The value of ETH invested in USD at the time of investment.

- “Gains in ETH” – This represents your current Balance in ETH value minus Invested.

- “ROI in USD” – Earning in USD terms calculated by subtracting the “Value at investment time” in USD from the current balance value in USD.

How to Stake with Staking Boost

Learning and Support