Ledger with Braavos on Starknet

Enjoy the security of the most popular cold wallet

Connect to Starknet’s DeFi dApps

Benefit from one-click transaction signing

Onboard Starknet without managing another seed phrase

Braavos Exclusive

Censorship Resistant

Account Abstraction

Crypto Innovation

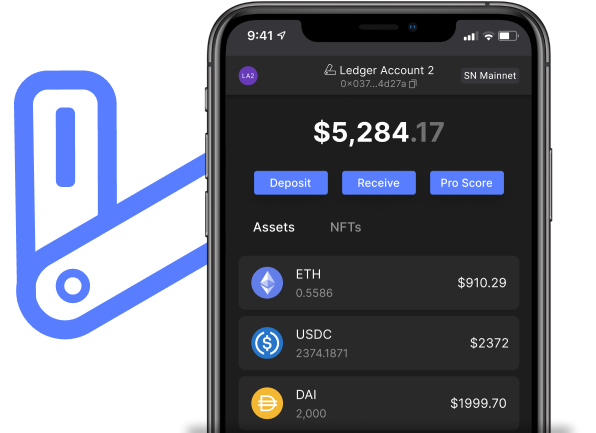

Enjoy the ease of a smart wallet with the familiarity of your favorite cold wallet.

Turn your favorite cold wallet into a smart wallet.

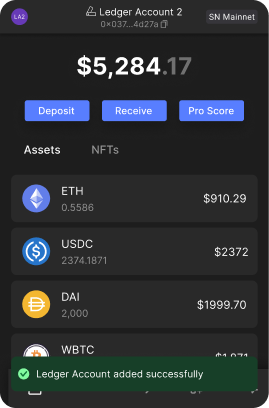

The Ledger integration with the Braavos wallet combines the benefits of a smart wallet with the familiar use of your Ledger cold wallet.

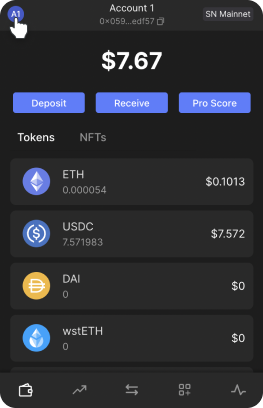

This integration lets you stake your ETH with one click for up to 10% yield directly from your Braavos wallet, and sign only one transaction instead of two when swapping tokens (multicall).

You can enjoy a smart wallet’s user-friendly features while signing transactions with your Ledger.

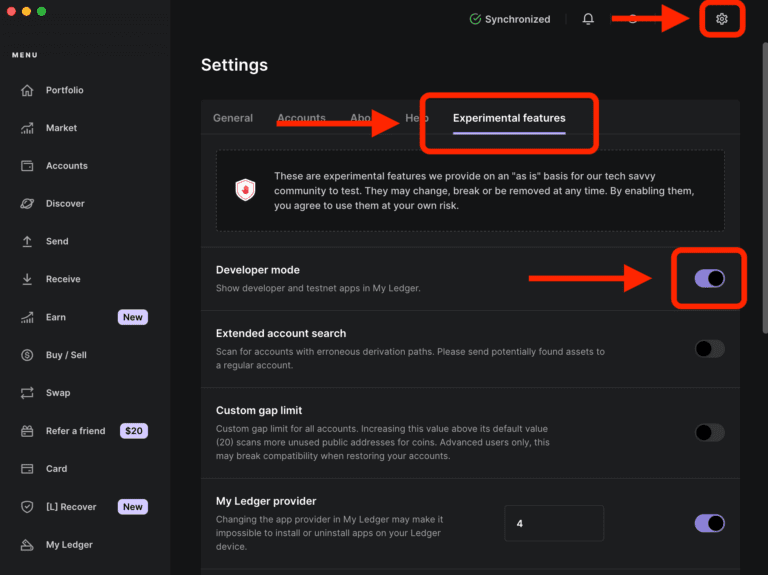

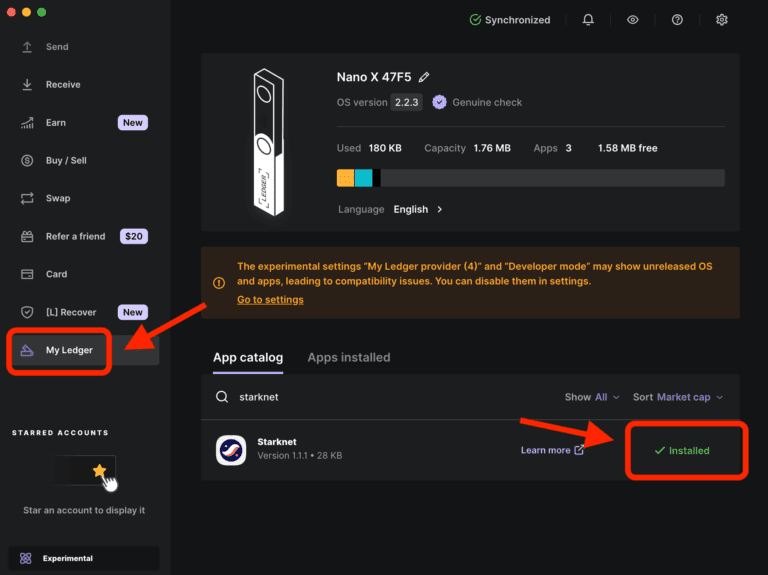

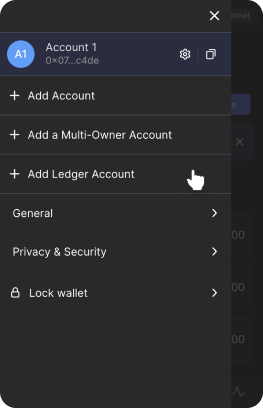

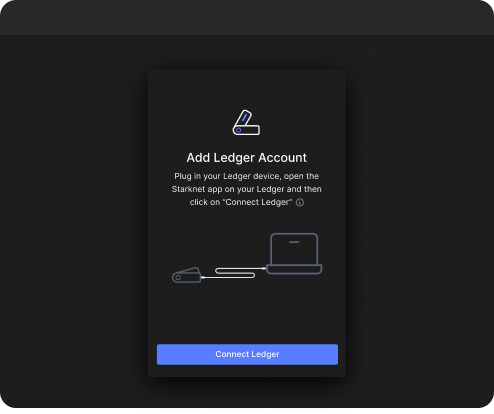

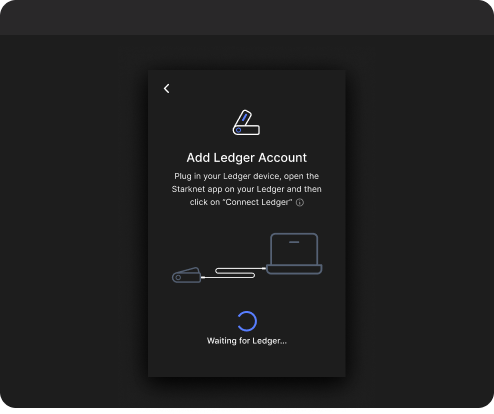

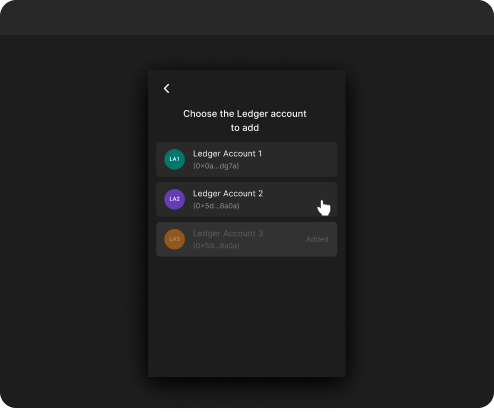

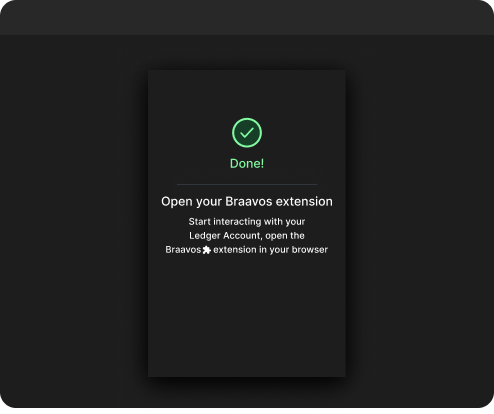

How to install the Starknet app in Ledger Live and add a Ledger account on Braavos

Learning and Support

Are you looking for support?

Join our community-driven live support on Discord