What Makes DeFi on Starknet So Special?

DeFi on Starknet is one of a kind. It boasts a unique combination of benefits not found elsewhere. Here are the four best things about Decentralized Finance on Starknet:

- DeFi protocols on Starknet offer some of the highest yields in the Ethereum Ecosystem. As of this writing, you can earn 397.61% APR on the STRK/ETH liquidity pool on mySwap.

- You can earn extra STRK yield thanks to the DeFi Spring Incentive Program from the Starknet Foundation, which started on February 22, 2024, and is expected to last until October 2024.

- Starknet is a zk-Rollup on Ethereum (Layer 2), known for its speed and low costs. It has the most scalability potential among other rollups. Thanks to EIP-4844 on Ethereum, simple transactions like transferring tokens cost less than $0.01

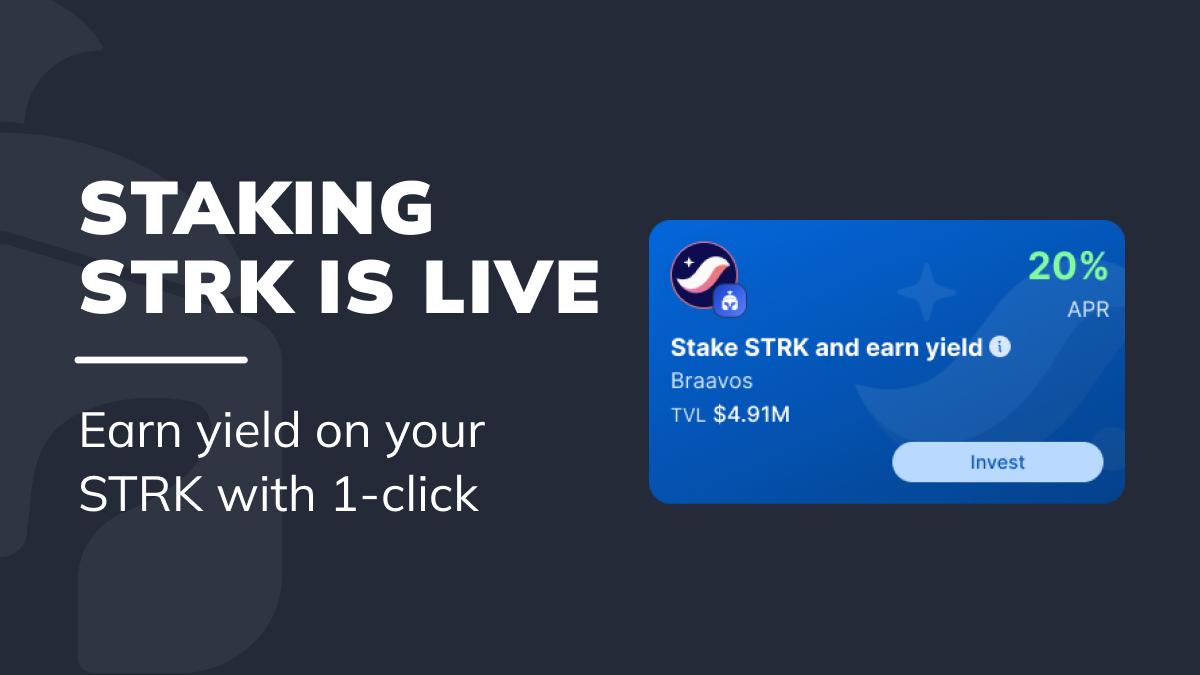

- Starknet features native Account Abstraction, enhancing security and user experience. Users can expect features like 2FA, 3FA, multisig, and one-click DeFi in their Braavos wallet, the fastest-growing Starknet wallet.

The 3 Pillars of DeFi On Starknet:

DeFi on Starknet comprises three major components: decentralized exchanges (DEXs), money-market protocols (also known as lending and borrowing protocols), and perpetual & options protocols.

1- Decentralized Exchanges (DEXs)

What are the benefits of using DEXs on Starknet?

- All the benefits mentioned above: high yield, STRK rewards, fast & cheap transactions, enhanced security, and ease of use.

- All the DEXs on Starknet are fast and simple to use. Thanks to Starknet’s native account abstraction, all the DEXs on Starknet benefit from multicall. This means you can approve spending tokens and swap them in a single atomic transaction. There are two main advantages: you pay less in gas fees, and you only need to sign one transaction (instead of two).

- The two largest DEXs on Starknet, mySwap and Ekubo, utilize concentrated liquidity. This means that when you use these DEXs, you can earn more APR with the same amount of liquidity, making your capital more efficient. However, this requires more technical knowledge and periodic rebalancing of your liquidity to continue earning yield.

How to use mySwap CL to swap tokens:

Step 1

Connect to mySwap.xyz and select the tokens you want to swap

Step 2

Type in the amount of tokens you want to swap and click on ‘Swap’

Step 3

Sign the transaction in your Braavos wallet

How to use mySwap CL to become a liquidity provider:

Step 1

Connect to mySwap.xyz and add a position

Step 2

Select the token pair and pool fee

Step 3

Add the liquidity and click on ‘Add’

Step 4

Sign the transaction in your Braavos wallet

How to earn STRK thanks to Starknet DEXs during the DeFi Spring:

Step 1

Connect to mySwap.xyz and add a position on one of the 7 participating pools

Step 2

Select the token pair and pool fee

Step 3

Add the liquidity and click on ‘Add’

Step 4

Sign the transaction in your Braavos wallet

Now let’s understand how money-market protocols work!

2- Lendings & Borrowing Protocols (Money Markets)

What are the benefits of using Money Markets on Starknet?

- All the benefits mentioned above: high yield, STRK rewards, fast & cheap transactions, enhanced security, and ease of use.

- All the Money-Market protocols on Starknet are fast and simple to use. Thanks to Starknet’s native account abstraction, all the Money-Market protocols on Starknet benefit from multicall. This means you can approve spending tokens and lend them in a single atomic transaction. There are two main advantages: you pay less in gas fees, and you only need to sign one transaction (instead of two).

How to provide liquidity to Nostra:

Step 1

Go to https://app.nostra.finance/ Nostra Finance and select a market

Step 2

Deposit liquidity (read carefully what it means to enable both lending and collateral)

Step 3

Sign the transaction in your Braavos wallet

How to provide liquidity to zkLend:

Step 1

Go to https://app.zklend.com/markets and select a market to supply liquidity to

Step 2

Type in the amount you want to supply and click on ‘supply’

Step 3

Sign the transaction in your Braavos wallet

How to earn STRK thanks to Starknet Money-Market protocols during the DeFi Spring:

Step 1

Go to https://app.nostra.finance/ and select one of the 4 participating markets

Step 2

Deposit liquidity (read carefully what it means to enable both lending and collateral)

Step 3

Sign the transaction in your Braavos wallet

3- Perps & Options Protocols (Perpetuals)

What are the benefits of using Perps & Options Protocols on Starknet?

- All the benefits mentioned above: high yield, STRK rewards, fast & cheap transactions, enhanced security, and ease of use.

- All the Perps & Options protocols on Starknet are fast and simple to use. Thanks to Starknet’s native account abstraction, all the Perps & Options protocols on Starknet benefit from multicall. This means you can approve spending tokens and lend them in a single atomic transaction. There are two main advantages: you pay less in gas fees, and you only need to sign one transaction (instead of two).

How to trade on Carmine:

Note: this is for advanced users. Use at your own risk.

Step 1

Select a market you want to trade, select if you want to go long, short and if you want to call or put

Step 2

Click on ‘Buy’ to start the trade

Step 3

Sign the transaction in your Braavos wallet

How to earn STRK thanks to Starknet Perps & Options Protocols during the DeFi Spring:

This section will be updated once the DeFi Spring for Money-Market protocols starts.

What Is The Best Wallet For DeFi On Starknet?

The Braavos wallet is the best wallet for DeFi on Starknet because:

- You benefit from 1-click DeFi, meaning that you can stake your ETH and earn yield in a single click

- You are protected from phishing attacks, malware, muggers, burglars, and kidnappers thanks to Braavos’ 3FA security

- You have all the DeFi dApps in one place in the Braavos dApp Gallery.

- You have a transaction tracker to keep all your transaction history in one place