Get yield on your ETH through staking on Braavos

By utilizing DeFi Pooling technology, Stake+ splits the high gas costs of Ethereum Layer 1 (L1) across

dozens of participants, thereby substantially lowering the gas fees for each individual user. With

reduced gas fees, small-scale investors can maintain profitability, as these costs no longer consume

their entire yield.

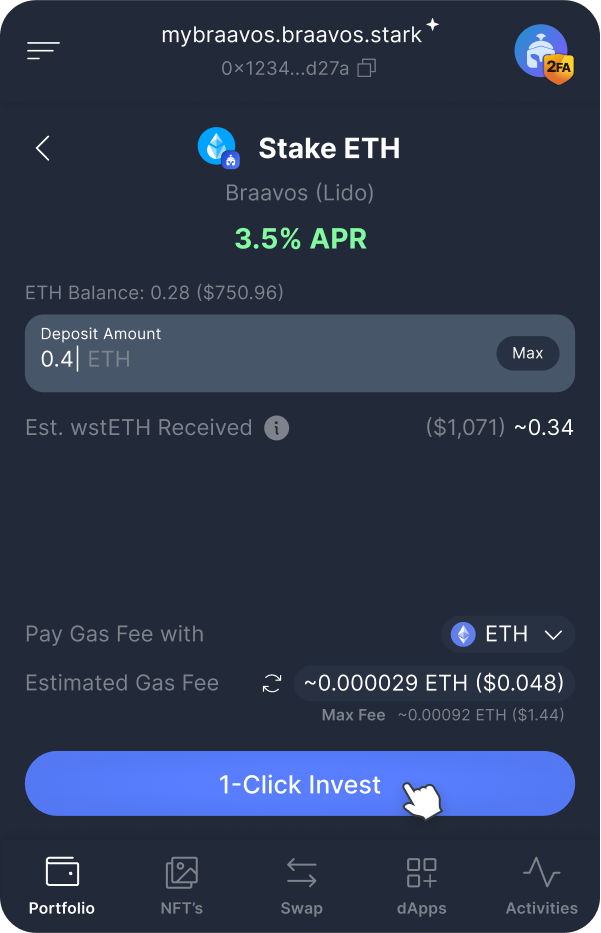

Staking Boost enables you to earn an extra yield on your staked ETH by becoming a liquidity provider in

the ETH-wstETH pool on mySwap AMM. All this in one click.

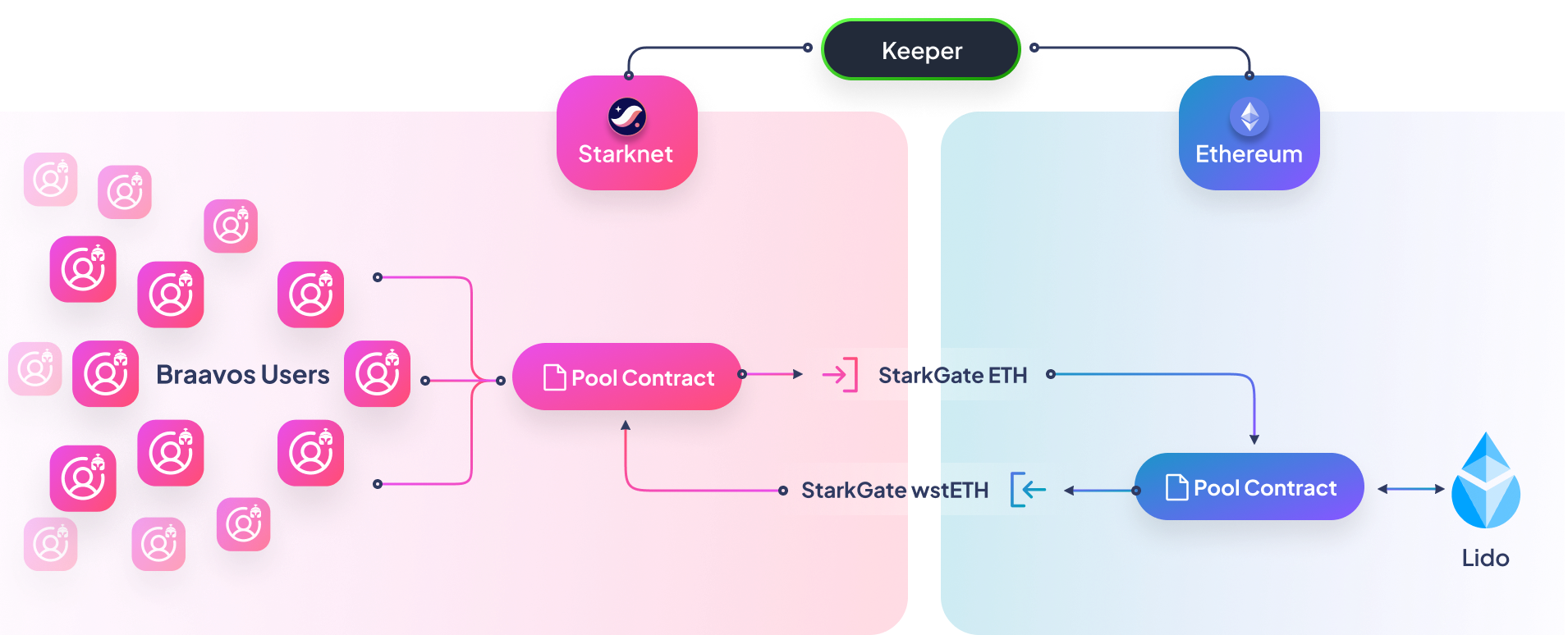

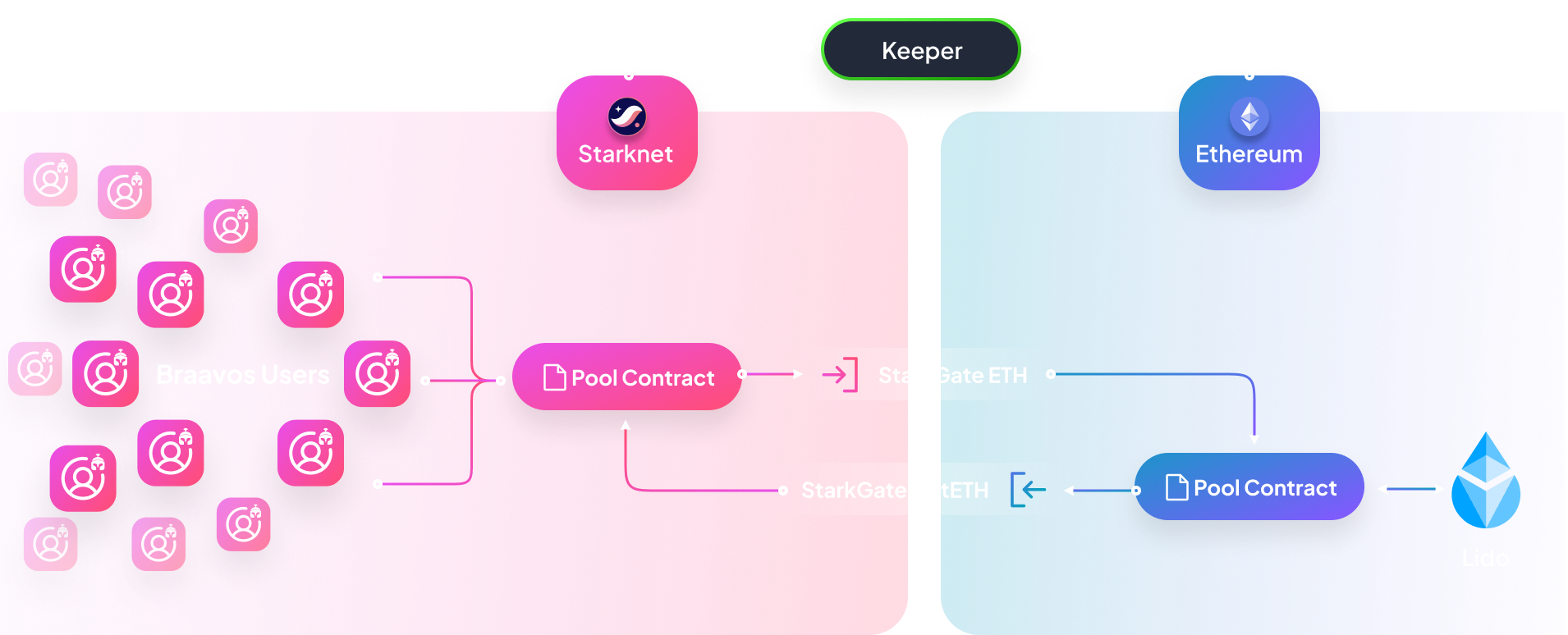

How does it work?

DeFi Pooling aggregates funds from numerous users into a smart contract on Starknet. These funds are then bridged to Ethereum (Layer 1) to be staked on Lido. The resulting tokens, wstETH, are returned to Starknet (Layer 2) and distributed to all users who deposited funds in the pool.

How long does it take?

Staking ETH with Stake+ takes up to 16 hours. This includes bridging ETH to Ethereum, staking it through

Lido, returning it as wstETH to Starknet, and distributing the liquid token into your wallet.

Similarly, withdrawing ETH also requires up to 16 hours, encompassing the withdrawal of your funds from

mySwap AMM, bridging of wstETH to Ethereum, unstaking through Lido, and bridging the ETH back to

Starknet.

The number of hours required for a roundtrip is expected to drop dramatically as Starknet gets more

mature.

Staking Boost or withdrawing happens in one click.

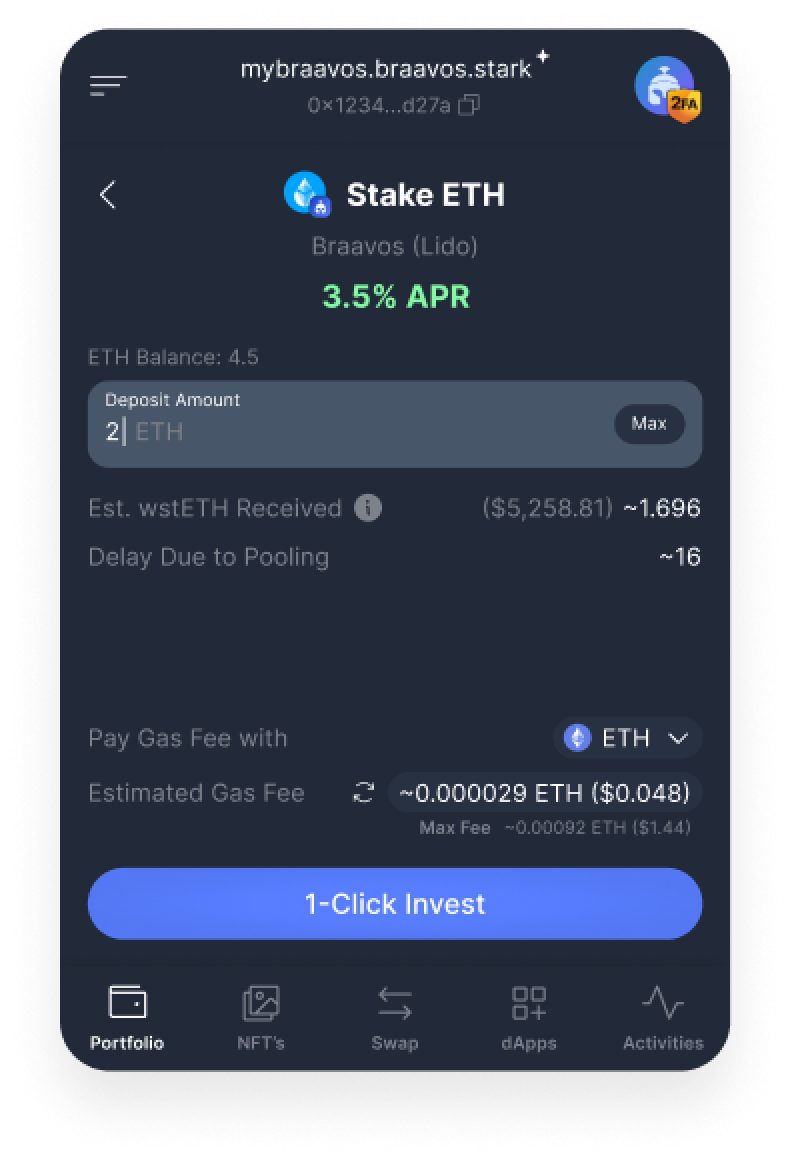

How much does it cost?

According to current gas prices, it will cost ~$0.01 to stake on Starknet via Braavos, while on Ethereum L1, it will cost 20x more.

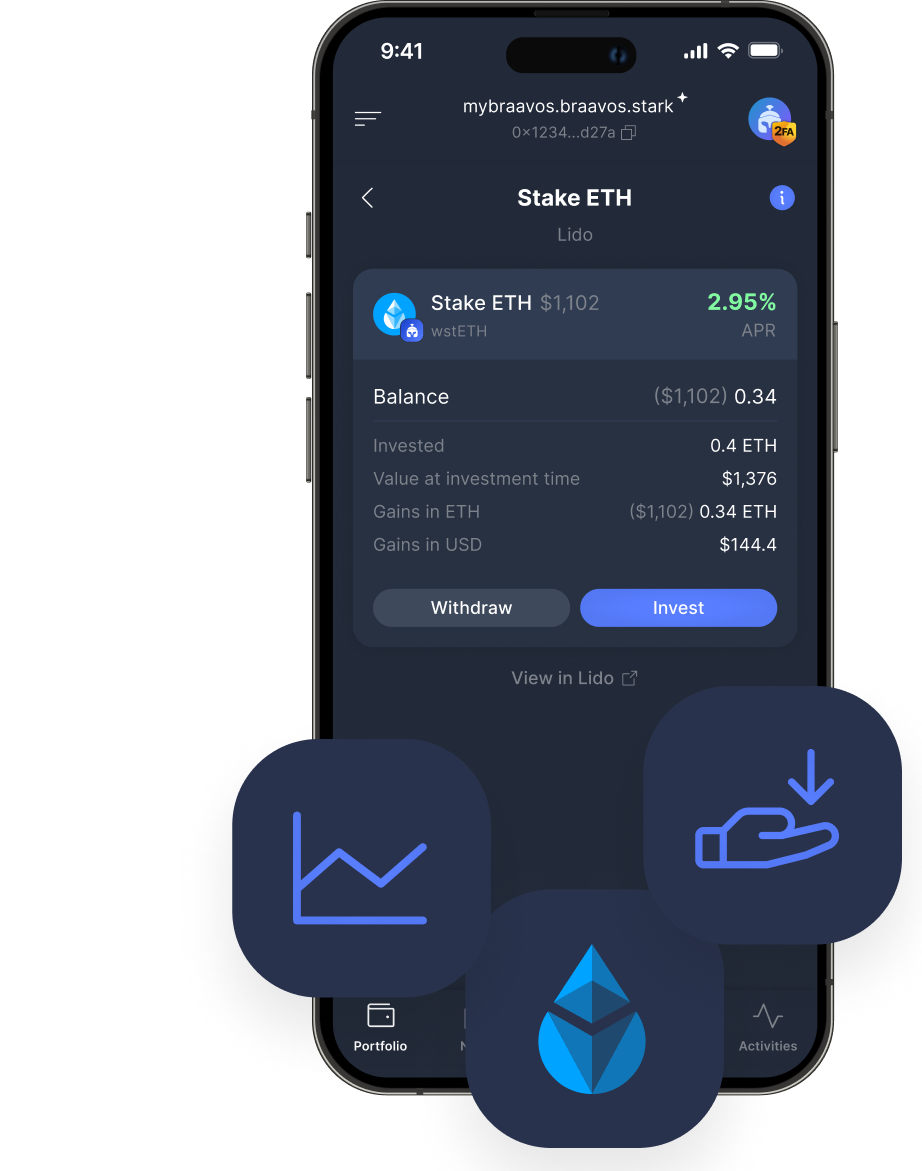

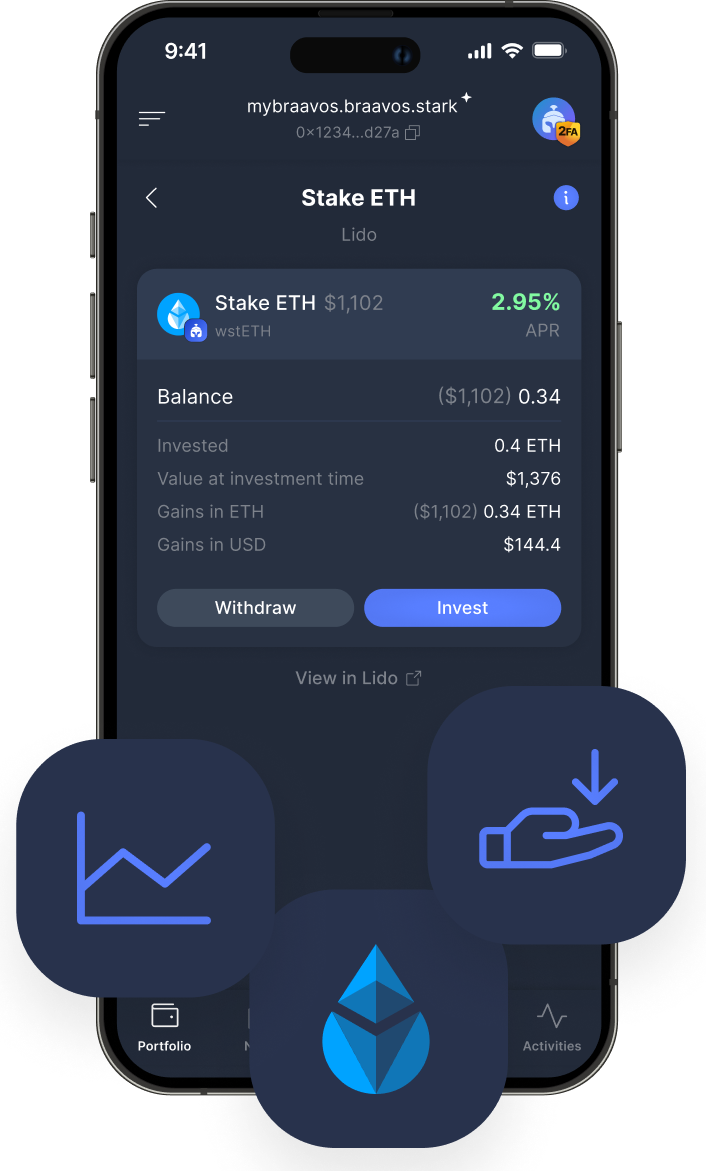

How can I see the details of my investment?

The Stake+ tab in your Braavos wallet displays details about your staked ETH:

- Balance – Your current balance

- Invested – This represents the total cost of your investments at the time of transaction, including assets sent, received or swapped

- Value at investment time – The value of ETH invested in USD at the time of investment

- Gains in ETH – This represents your current Balance in ETH value minus Invested

- ROI in USD – Earning in USD terms calculated by subtracting the “Value at investment time” in USD from the current balance value in USD

How to Stake ETH

Download Today

Enjoy a next generation wallet designed for a safe and intuitive start